"Micro"- Managing The Housing Demand Of The 20-34 Year-Old Demographic

It's the summertime, which means that the city has been void of late night college parties from raucous undergrad newbies since graduations in May. But the 20-to-34 year-old youth demographic still prevails in Boston proper, making up one-third of the city's population; the highest proportion of young adults for any major US city.

Boston area real estate remains high in price; unaffected by the loss of graduation and move-outs as many college students have returned to their permanent residences out of town. Currently, there is a reported shortage of 25,000 affordable apartment units, and developers scrambling to meet demand.

Boston area real estate remains high in price; unaffected by the loss of graduation and move-outs as many college students have returned to their permanent residences out of town. Currently, there is a reported shortage of 25,000 affordable apartment units, and developers scrambling to meet demand.

Less Is More (Than What You Bargained) For The City's Youth

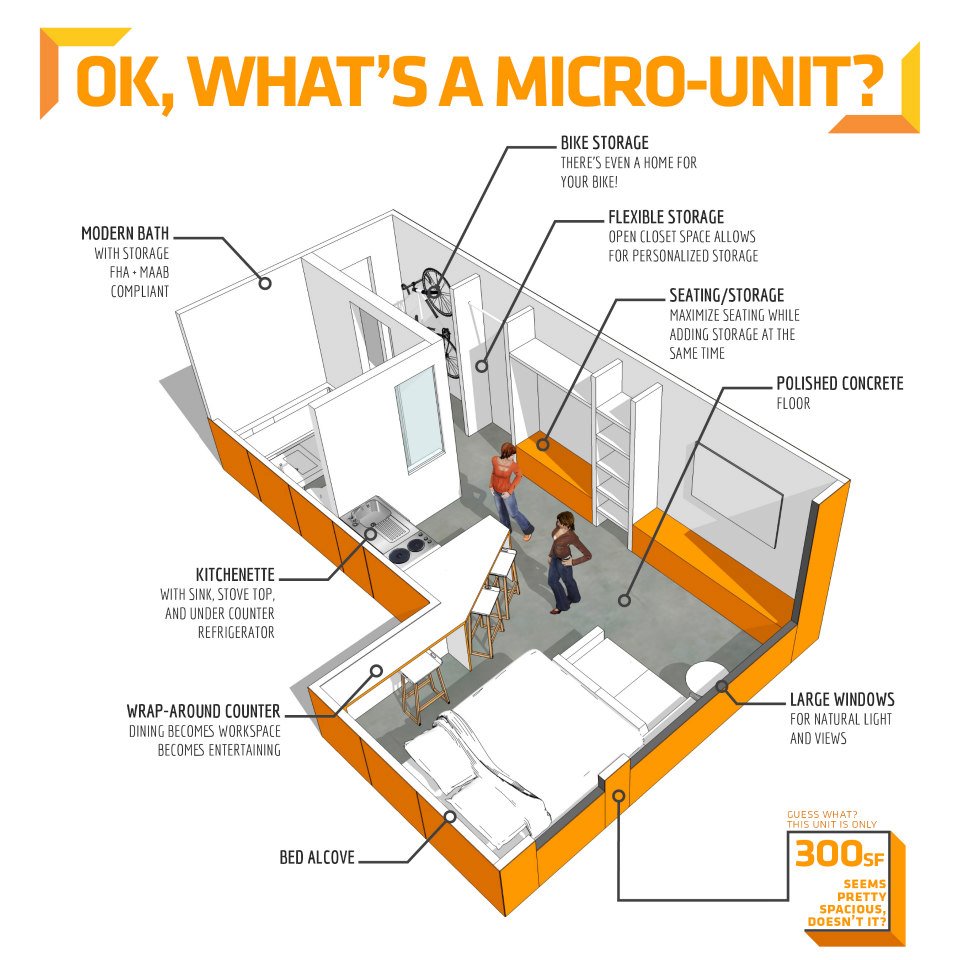

Boston's current condo craze has left many young renters in the financial dust while they encounter a lack of affordable housing. The micro-apartment was part of the Onein3 initiative implemented by the Menino adminstration in 2004 to provide resources that cater to the city's young population, including housing, professional development, financial health, entrepreneurship, and civic engagement. A micro-apartment unit is approximately 250 to 500 square feet in size, with a minimalistic design equipped with the bare essentials to live. Also, to attract young professionals toward the city, the initiative mandated that these micro-apartments be within one mile of public transportation.

So why should the mayor's office cater to young professionals?

So why should the mayor's office cater to young professionals?

- They comprise almost half of Boston's workforce at 48%

- 60% of them rent their homes

- Only 20% own their homes

- Most are single, and 82% have never married

- They add one billion dollars to the City Gross Product

- Their expenditures support 22,241 additional jobs to the city's economy

- 60% of them were born outside of Massachusetts

- 58% of these young adults either bike, walk, or take MBTA public transportation to work

I'm (Not) So Fancy: Trial Sizing Up Price for Millenials and Gen-Y Renters In Other U.S. Cities

Boston's economy relies on this segment of its population, and surely needs to have affordable housing for them to remain here. This is a microcosm (excuse the pun) of the development trend across the US. Developers are betting big on the lack of sufficient housing for recent college graduates and young upstart professionals. Here is a list of cities that have tapped into the market of the 80 million Millenials and Generation Y-ers between the ages of 18 to 34 in the US:

These trendy apartments are going up in Cambridge, Fort Point near the "Innovative District", Charlestown, and the South End where young techies can live, work, play, live small, and think big. Looks like developers are betting on tenants buying into a trend of living by necessity rather than luxury, and focusing on the inexpensive monthly cost rather than square footage. But it may be hard to maintain focus on just square footage when you are a renter paying a rate that is relatively high per the cost of living just enough to say you are living in the city.

- Cleveland

- New York

- Providence

- Washington D.C.

- Seattle

- In Cleveland's University Circle District, a 300-square foot micro-apartment has a monthly rate of $600 per month. Sure, $600 may seem reasonable until you consider the square footage you are(n't) getting.

- These micro-units aren't exempt from location-based cost of living hikes - compare Cleveland's $600 to the price of a micro-apartment complex like Factory 63 in Fort Point, where the price range for a 337-square foot apartment is $1200 per month, and a 597-square foot apartment is $2450 per month.

Big Bucks for Small Spaces?

Do you believe that these micro-apartments can build small and sell high? Or will developers find themselves with a micro-demand as small as the apartments they are renting? Will this eliminate the need for property management for these small-sized apartment units? Tell us your thoughts.

No comments :

Post a Comment